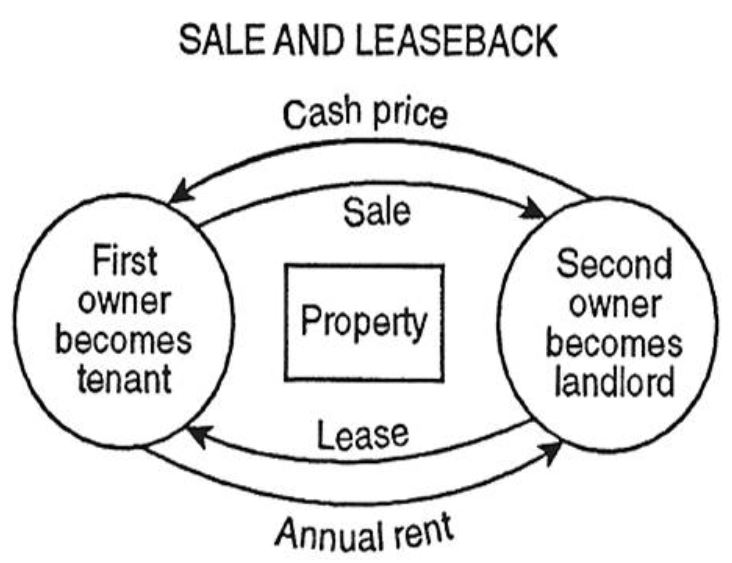

What is a "Sale-Leaseback"?

Not to be confused with "Lease-With-Option To Buy", a Sale-Leaseback is when the current business which occupies a property, sells the property to an investor and remains as the tenant and continues their business operations. This is not some mystical, unheard of sleight-of-hand. Corporations of all size use this tactic, such as CVS Pharmacy, Walgreens, Starbucks, McDonald's, and Home Depot. A typical development model for such companies is to seek out, purchase and develop specific properties for their own business operations. The newly-built and occupied property is now offered-up to investors as a Sale-Leaseback, offering favorable lease terms, and freeing up capital for the company to “Rinse and Repeat”. It is also not unusual for major corporations to sell, then leaseback their own corporate offices.

Could a Sale-Leaseback Benefit You?

There are numerous advantages to a Sale-Leaseback from both the perspective of an Investor/Buyer and for the Owner/Seller.

Following is a guide offering both sides.

As the Owner/Seller of the property:

Are you a good candidate for a Sale-Leaseback?

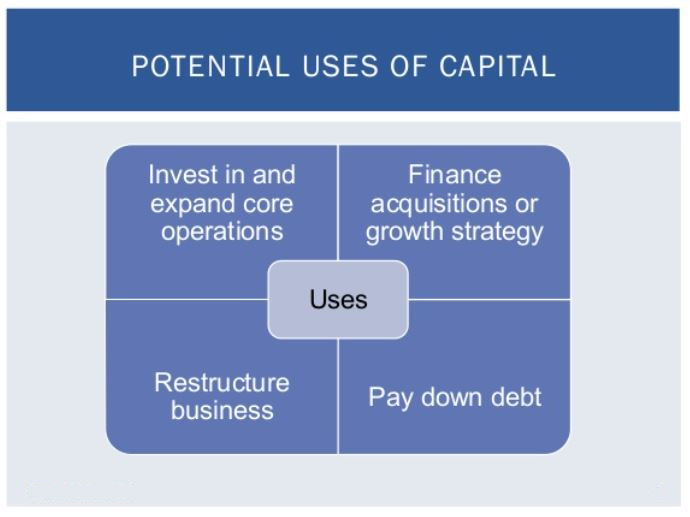

- Could your business, or you personally (if you are the owner) make good use of the funds which would be freed-up from the sale of the property?

- Most property types are appropriate for a Sale-Leaseback, such as medical, office, retail, and industrial. We are also seeing interest for residential situations where the homeowner decides to sell and remain as a tenant. This can be for various reasons; pending foreclosure, an alternative to a HELOC (Home Equity Line of Credit), or an alternative to a Reverse Mortgage.

- Regarding your Credit: The better your credit, the better terms you can negotiate. However, a major factor which will be considered by a potential buyer is your business record. If your business has a solid operating history and a healthy and stable income, you should be considered a good tenant to a potential buyer.

- Keep in mind; the longer you would be willing to commit to for the lease, the better.

- If you would be willing to commit to a triple-net lease (often referred to as a “NNN Lease” where you would agree to be responsible for any and all operating expenses and repairs/improvements), this deal would be much more appealing to a potential buyer. (In reality, as the current owner you are already in this situation, so this part would not change.)

As the Investor/Buyer of the property:

- Are you able and willing to commit funds on a long-term basis to a property which should not expect a turnover of its tenant?

- Most property types are appropriate for a Sale-Leaseback, such as medical, office, retail, industrial, and even residential single-family homes. Do these property and business-types match your portfolio goals and needs?

- Would you be willing to commit to a lease of several years; perhaps even ten years, at the current market rate? Keep in mind; the final terms of the lease are negotiated simultaneously with the terms of the sale.

- Would you be willing to commit to a triple net lease (often referred to as a “NNN Lease”) which would say that you agree to the tenant being responsible for any and all operating expenses and repairs/improvements.

Again, keep in mind; the final terms of the lease are negotiated simultaneously with the terms of the sale. Therefore, if they do not fit the needs of EITHER party, the deal will not go forward.

There are definite advantages to be learned from tax accountants, financiers, and numerous professions with this business model. For more on this, check out our page on "Professional Practice Transition".

Contact us to discuss how a Sale-Leaseback might benefit you

email: Steve@SteveHerb.com

Phone: 740-334-1018